The Meezan Bank Saving Account Profit Rates 2025 have been officially updated for September, and customers can now earn up to 6.63% monthly profit across all major saving account types. Whether you hold a Meezan Rupee Saving Account, Meezan Bachat Account, or even a Meezan Kids or Senior Citizen Account, the same consistent 6.63% annual rate (on a monthly basis) applies.

Note: The October 2025 profit rates are expected to be announced soon. Currently, the September 2025 rates remain applicable across all Meezan Bank saving accounts.

This detailed guide explains the latest Meezan Bank profit rates, account types, eligibility criteria, and how these Islamic profit-sharing models differ from conventional interest systems. If you’re planning to open a halal savings account, this guide will help you choose the best option.

Quick Facts – Meezan Bank Saving Account Profit Rates (September 2025)

| Account Type | Profit Rate (Monthly) |

| Meezan Rupee Saving Account | 6.63% |

| Meezan Asaan Saving Account | 6.63% |

| Meezan Bachat Account | 6.63% |

| Meezan Roshan Digital Account (PKR) | 6.63% |

| Meezan Kids Club Account | 6.63% |

| Meezan Teens Club Account | 6.63% |

| Meezan Senior Citizen Account | 6.63% |

| Meezan Asaan Student Account | 6.63% |

| Meezan Asaan Remittance Account (MARA) | 6.63% |

| Labbaik Saving Aasaan Account | 6.63% |

Understanding the Meezan Bank Saving Account System

Meezan Bank, Pakistan’s first and largest Islamic bank, operates under a Shariah-compliant profit-sharing model called Mudarabah. Instead of earning interest (riba), customers share in the profits generated from halal business ventures.

This makes your savings purely Islamic, ethically invested, and stable in returns — a key reason why Meezan remains Pakistan’s most trusted Islamic bank.

Types of Meezan Bank Saving Accounts (2025)

Meezan Bank offers several saving account options tailored for different customer needs. Here’s a brief look at each:

1. Meezan Rupee Saving Account

A standard account for individuals who want monthly profit payouts with easy access to funds.

Profit Rate: 6.63%

Profit Payment: Monthly

Minimum Balance: Rs. 1,000

2. Meezan Asaan Saving Account

Best for first-time savers or customers with basic documentation.

Profit Rate: 6.63%

Profit Frequency: Monthly

Documents Required: CNIC only

3. Meezan Bachat Account

A flexible savings account allowing free withdrawals without losing your monthly profit share.

Profit Rate: 6.63%

Minimum Balance: Rs. 1,000

4. Meezan Roshan Digital Account (PKR)

Made for overseas Pakistanis who want to save or invest in Pakistan.

Profit Rate: 6.63%

Currency: PKR

Access: 100% online banking

5. Meezan Kids & Teens Club Accounts

Encourages early saving habits among children and young adults.

Profit Rate: 6.63%

Extras: Free debit card and welcome kit

6. Meezan Senior Citizen Account

Tailored for retirees and senior citizens who rely on monthly income.

Profit Rate: 6.63%

Benefits: Free cheque book, ATM facility, and priority service

7. Meezan Asaan Student Account

Perfect for students wanting to save small amounts from pocket money or part-time work.

Profit Rate: 6.63%

Minimum Balance: None

8. Meezan Asaan Remittance Account (MARA)

Specially designed for beneficiaries receiving international remittances through Islamic banking.

Profit Rate: 6.63%

Features: Instant remittance credit and easy withdrawal

9. Labbaik Saving Aasaan Account

Ideal for those saving for Hajj or Umrah.

Profit Rate: 6.63%

Profit Distribution: Monthly halal profit

Meezan Bank Mahana Munafa Plan – Monthly Income Account

The Mahana Munafa Account by Meezan Bank offers monthly profit payouts — great for retirees, freelancers, and business owners looking for regular halal income.

- Profit Rate: 6.63% (as of September 2025)

- Profit Type: Halal Mudarabah-based

- Profit Frequency: Monthly

- Access: Available at all branches and via internet banking

This plan gives you steady, predictable monthly income while staying fully Islamic.

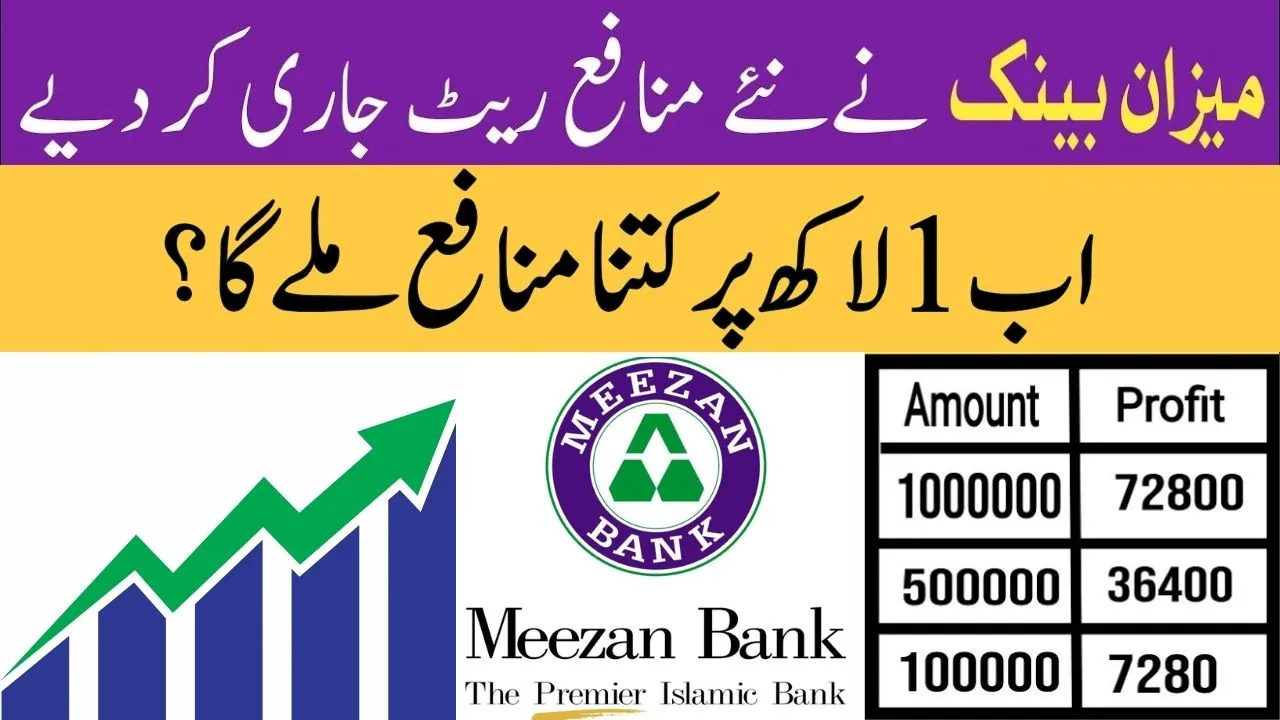

How Much Profit Can You Earn on Rs. 1 Lakh in Meezan Bank?

If you deposit Rs. 100,000, you can expect to earn approximately Rs. 550–650 profit per month depending on the declared ratio.

Because this is a Mudarabah partnership, the exact monthly return may vary slightly — but the profit remains Shariah-compliant and consistent.

Comparison – Islamic Banks Profit Rates (September 2025)

| Bank Name | Profit Rate (Monthly) |

| Meezan Bank | 6.63% |

| Bank Islami | 6.50% |

| Faysal Islamic Bank | 6.40% |

| HBL Islamic | 6.35% |

| Allied Islamic | 6.25% |

Meezan Bank continues to lead the Islamic banking sector in Pakistan with one of the highest halal profit rates available.

Eligibility & Required Documents

To open a Meezan Bank saving account, you’ll need:

- Valid CNIC

- Proof of income (for salaried persons)

- Minimum initial deposit

- 2 passport-size photos

For students or low-income users, the Meezan Asaan Account can be opened with CNIC only and minimal documentation.

How to Open a Meezan Bank Saving Account Online

Opening a Meezan Bank saving account is now easy and 100% digital:

- Visit the official Meezan Bank website.

- Choose your preferred account type (Saving, Asaan, or Roshan Digital).

- Fill out the Online Account Opening Form.

- Upload your CNIC and other documents.

- Wait for verification — approval usually takes 2–3 working days.

Or, visit any Meezan branch for same-day account setup.

Why Choose Meezan Bank for Savings?

- 100% Shariah-compliant and riba-free

- Stable 6.63% profit rate (September 2025)

- Wide branch and ATM network

- Easy online and mobile banking access

- Trusted by millions of Pakistanis for halal savings

Conclusion

The Meezan Bank Saving Account Profit Rate for September 2025 stands firm at 6.63%, making it one of the highest halal returns in Pakistan.

Whether you’re a student, senior citizen, freelancer, or overseas Pakistani, Meezan Bank offers a safe, Shariah-compliant, and reliable way to grow your money.

The October 2025 rates are expected to be announced soon — but for now, the September 2025 profit ratio remains in effect.

If you’re planning to open a saving account this month, Meezan Bank remains the best Islamic banking choice for stable halal profit and long-term financial growth.